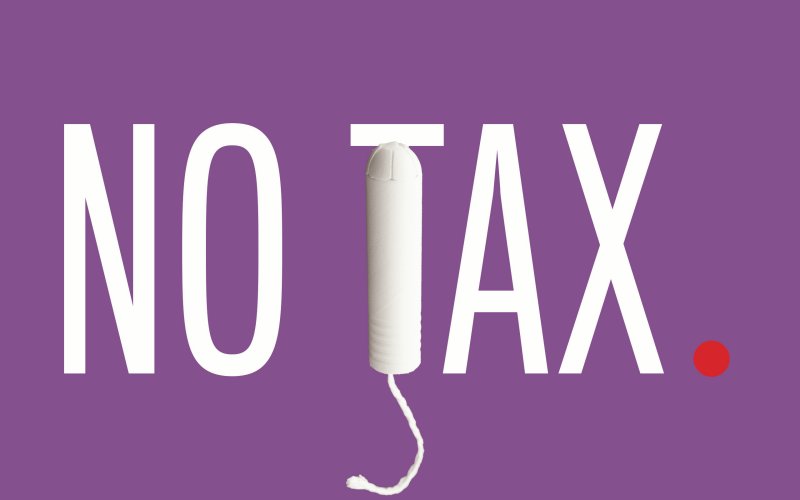

Women’s issues: Stop taxing feminine sanitary products by classifying them as “luxury items”

By Isabel Gibson Penrose, Opinions Editor

March is Women’s History Month, and in honor of all the women who have fought for the rights I have today I will be writing an article about a different issue facing women every week of March. This week’s topic is the sales tax on feminine sanitary products.

The average woman begins menstruating at the age of 12 and goes through menopause at the age of 51. That’s 39 years of menstruation. The average box of tampons costs $6.79, the average package of pads costs $7.99 and the average woman uses approximately 9 boxes of tampons and 7 packages of pads a year. Over 39 years that’s $2,383.39 spent on tampons and $2,317.77 spent on pads. This means the average American woman will spend about $5,000 on tampons and pads over the course of her life – and she will be taxed the entire time because the average American woman is financially penalized from the minute she starts menstruating.

The high cost of tampons and pads is an issue in itself, and if I had my way women would get feminine sanitary products for free because it is not as if any of us chose to have to suffer through shedding our uterine lining every month, but as it stands right now I am only addressing one small part of the problems American women face when it comes to our time of the month: the so-called tampon tax.

The tampon tax gets is name from the sales tax that is applied to feminine sanitary products in forty states around the country. Tampons and pads are taxed despite the fact that all forty-five states with sales tax allow for exemptions for necessities like groceries. Five states (shout out to Maryland, Massachusetts, Pennsylvania, Minnesota, and New Jersey) have explicitly eliminated sales tax on pads and tampons, and California and Ohio have legislation to do that same thing in the works. That would make a total of seven states that no longer tax feminine sanitary products, as compared to fifteen states that treat candy as a sales tax-exempt item (and of those fifteen states, ten of them impose sales tax on feminine sanitary products). The fact that candy is exempt from sales tax and considered a “necessity” in more states than feminine sanitary products are is a perfect demonstration of where women are ranked on the scale of American priorities. If you’re in Arizona, Georgia, Louisiana, Michigan, Nebraska, Nevada, New Mexico, South Carolina, Vermont or Wyoming you can buy a package of sour gummy worms without sales tax, but God forbid you want to do the same thing with a box of tampons.

I should be clear that tampons and pads are not luxury items. In fact, the Food and Drug Administration classifies tampons and pads as medical devices because they are “intended to affect the structure or function of the body.” Ask anyone who has every menstruated and they will tell you there is nothing luxurious about it. There’s nothing luxurious about buying tampons, either. Over the summer I headed to the checkout counter of Target to buy my unused, unopened, but fully sales-taxable tampons, and I received a look of disgust and an audible “ew” from two grown men. Even more aggravating, I still had to pay sales tax even after being “ew”-ed at by two adult men who couldn’t stand the sight of a box of tampons.

President Barack Obama was recently made aware of the tampon tax when he was interviewed by YouTube personality Ingrid Nilsen. I love President Obama but was not exactly surprised when he admitted that Nilsen’s question to him marked the first he had heard of this issue. He offered, “I have no idea why states would tax these as luxury items…I suspect it’s because men were making the laws when those taxes were passed.” This brings us back to the two men who “ew”-ed at me over the summer. Sorry I keep bringing you up, fellas, but you really embody the male fear of menstruation for me. Men do not like talking about feminine sanitary products and therefore tax code discussions went without mentioning them at all, making them more comfortable and the tax laws they wrote less progressive for women.

Some have argued the fight against the tampon tax is overblown, usually by pointing out that some states have sales tax on other things viewed in the same vein as tampons, like toilet paper. My main problem with this argument is that those making it are missing the point. If your state has a tax on toilet paper, everyone in your state is going to be paying it. It’s not as if half the people don’t have to use toilet paper because they are biologically fortunate and never have to go to the bathroom. The tampon tax is a problem because it adds another thing to the long list of burdens women deal with every day, and it is yet another problem we have to deal with being told to stop complaining about. When it comes down to it, tax codes should not discriminate, even if it is by a few cents.

I understand the financial burden imposed by sales tax on feminine sanitary products is not that large. I mean, the dollars saved would probably come in handy, especially since women get paid less than men anyway (keep reading Women’s Issues this month for more on that), but the truly frustrating thing is when various state tax codes were written women were so voiceless nobody even bothered to include feminine sanitary products in the tax codes. No man involved in writing tax laws stopped to consider if they were placing an undo burden on women by leaving out feminine sanitary products entirely, and today’s women are still paying for it.

Being a woman already comes with financial burdens like purchasing birth control, medication for relief of premenstrual syndrome and essential exams for gynecological health, and having another expense (no matter how low it is) is unacceptable. The actual cost is irrelevant. Getting rid of sales tax on feminine sanitary products is about ensuring women are equally represented in tax codes across the country. This small step towards equal representation will require tax laws to be amended to include feminine sanitary products in the “necessity” category because not viewing menstruation as something necessary undermines women and their bodies and it needs to stop.