By Alfredo Roman Jordan, Staff Columnist

In my two years at Gettysburg College, I’ve noticed a recurring trend: students here often have a pessimistic view of the College. However, after reading through the College factbook, tax filings available through ProPublica and the College’s endowment report, I’ve come to realize that our college is slowly inching toward a financial precipice. Students’ pessimistic views may be correct; the grass may actually be greener at other institutions. The College’s focus on avoiding the enrollment cliff and improving acceptance rates is inadvertently pushing us further into financial decline.

These are the facts:

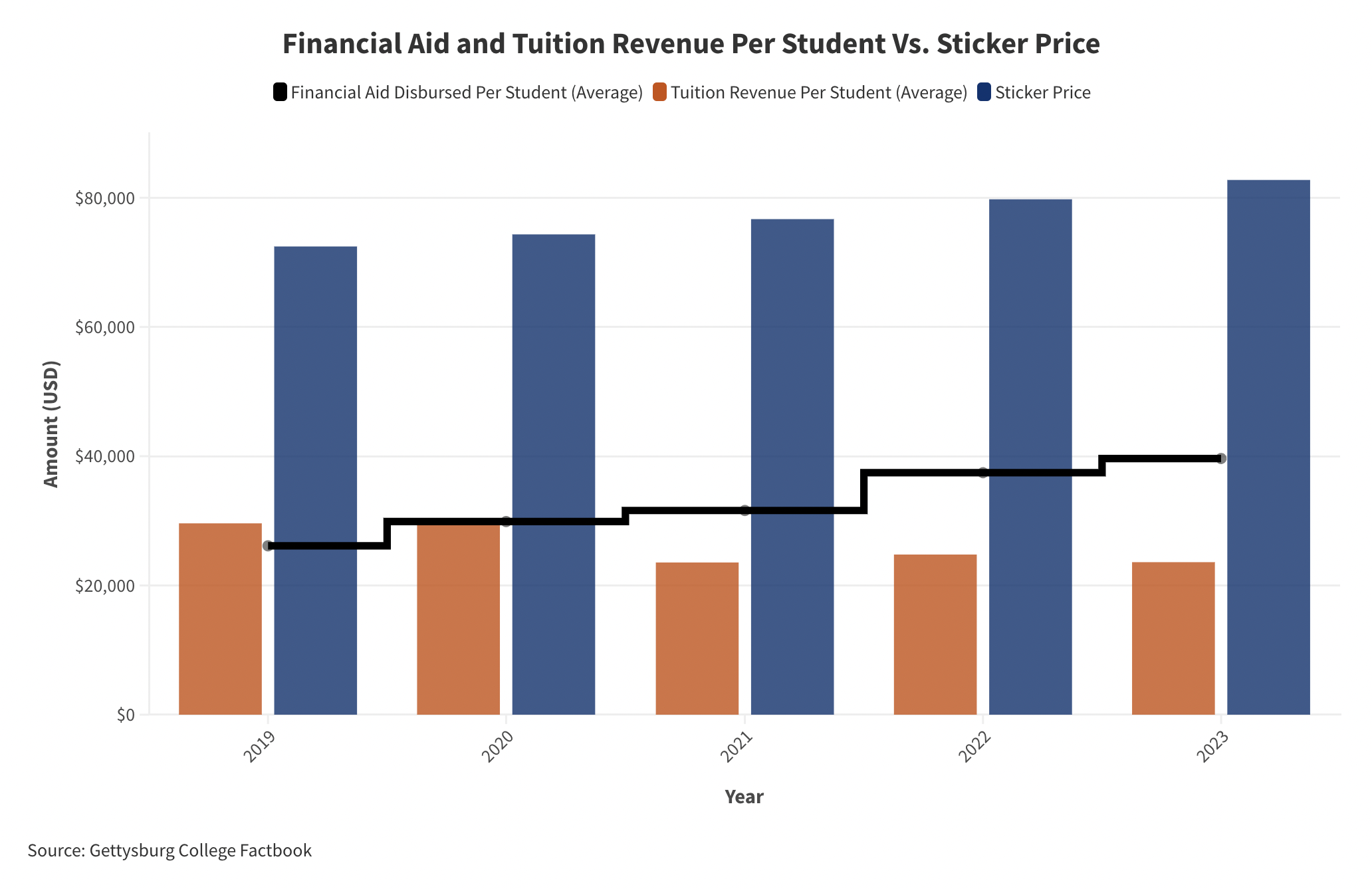

Fact 1: Tuition revenue per student is down.

Visual created by Alfredo Roman-Jordan

The average student now pays significantly less in tuition compared to just five years ago, with financial aid, including grants, filling the gap. Specifically, the average student pays 21% less in tuition while receiving 52% more aid. This has led to a substantial increase in financial aid and grants, which costs Gettysburg College an additional $24 million despite the decreased enrollment. Why is the College taking on this financial burden?

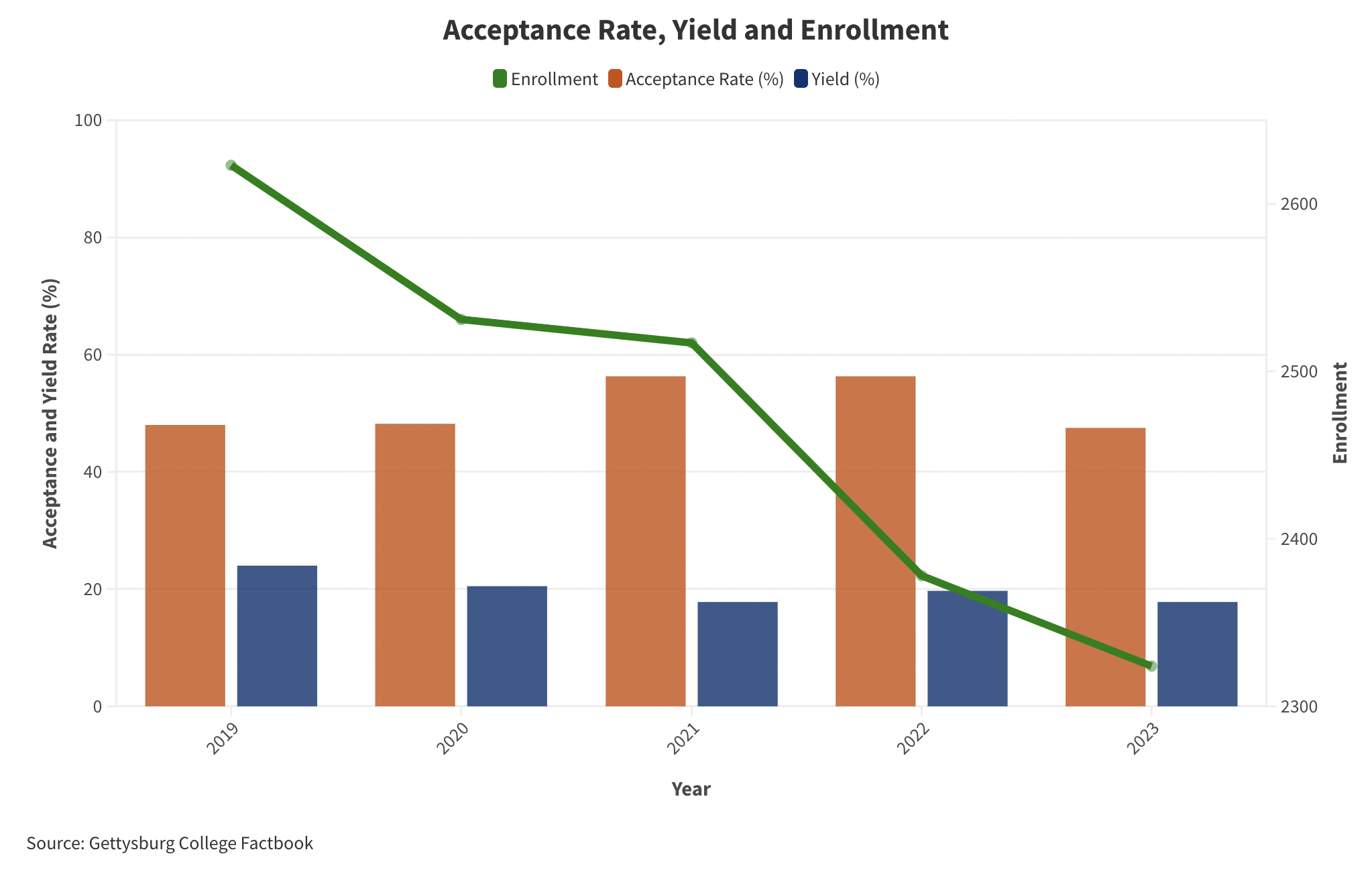

Fact 2: The admissions landscape looks bleak, but is also improving.

Visual created by Alfredo Roman Jordan

My theory? It seems the College is trying to become more attractive to prospective students by lowering costs, effectively becoming a “cheaper school.” Our acceptance rate peaked after the pandemic at 56%, but it has slowly been decreasing. Unfortunately, our yield rate — the percentage of accepted students who choose to enroll — has steadily dropped by seven points since 2019, now sitting at just 18%. This is consistent with national trends, as students apply to more schools and receive more acceptances. For instance, Dickinson’s yield is similar to ours. Despite record application numbers, around 50% come from international students, who see Gettysburg as a good safety school with amazing aid.

But if the College is lowering the average cost per student to attract more applicants, where is this lost revenue coming from?

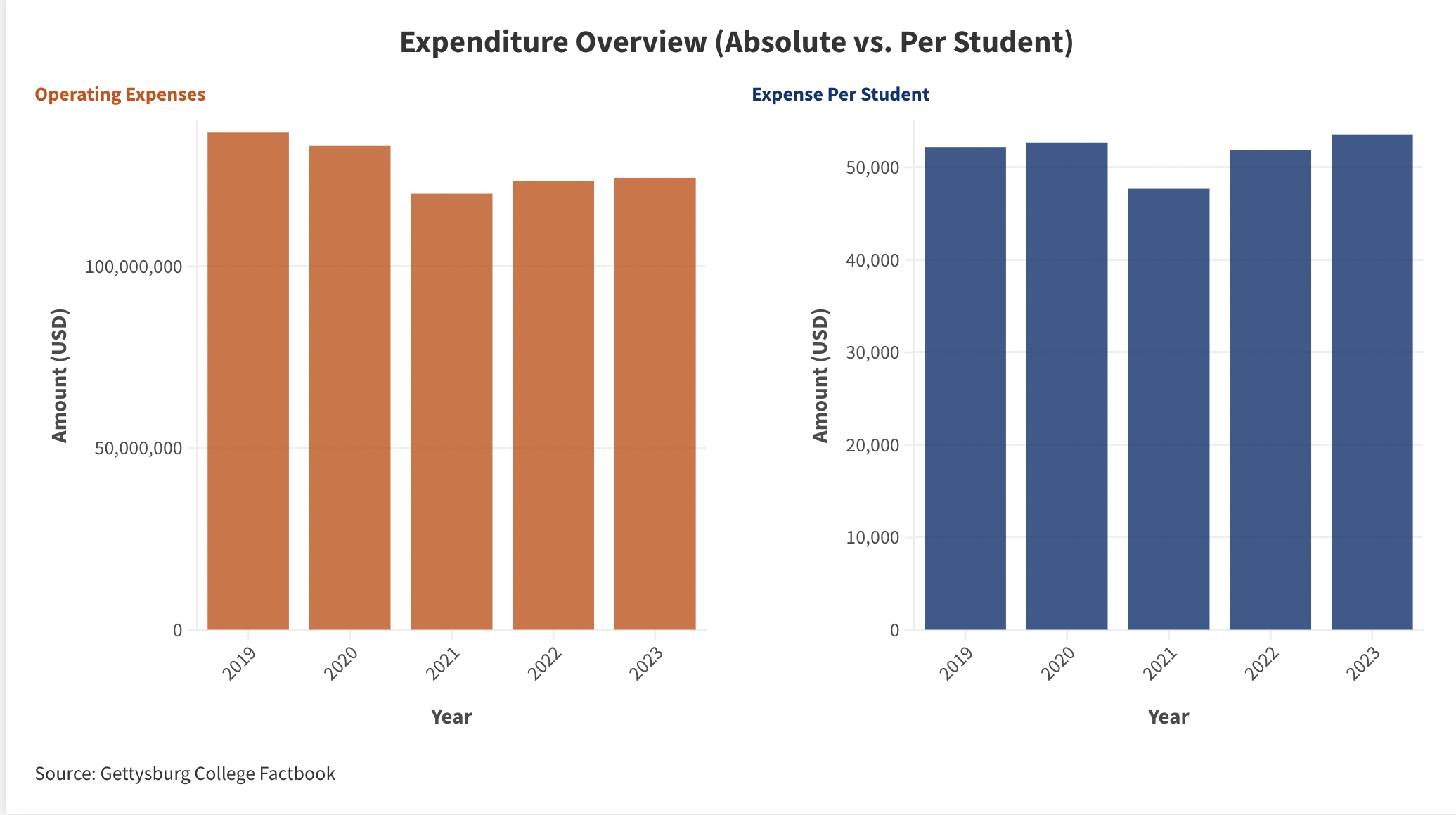

Fact 3: Total spending has decreased, but at a cost.

Visual created by Alfredo Roman Jordan

While overall spending has decreased — from $136 million in 2019 to $124 million in 2023 — students have felt the impact. Programs like the Gettysburg Review have closed, the CWI Fellows experienced funding cuts, administrative assistants are being shared among multiple departments, library resources are stretched thin, the Student Senate’s budget has been reduced and salaries are increasing more slowly. Moreover, the College is losing faculty. Although expenditure per student has increased by about 2% since 2019, reaching $53,520, this small increase still compounds with the financial strain. Downsizing any business is harder than upsizing, and Gettysburg is proving that every day.

Side Fact: Only a third of tuition goes towards instruction.

Visual created by Alfredo Roman Jordan

So, if the College is spending an equal amount of money per student, but charging less, where is this difference coming from?

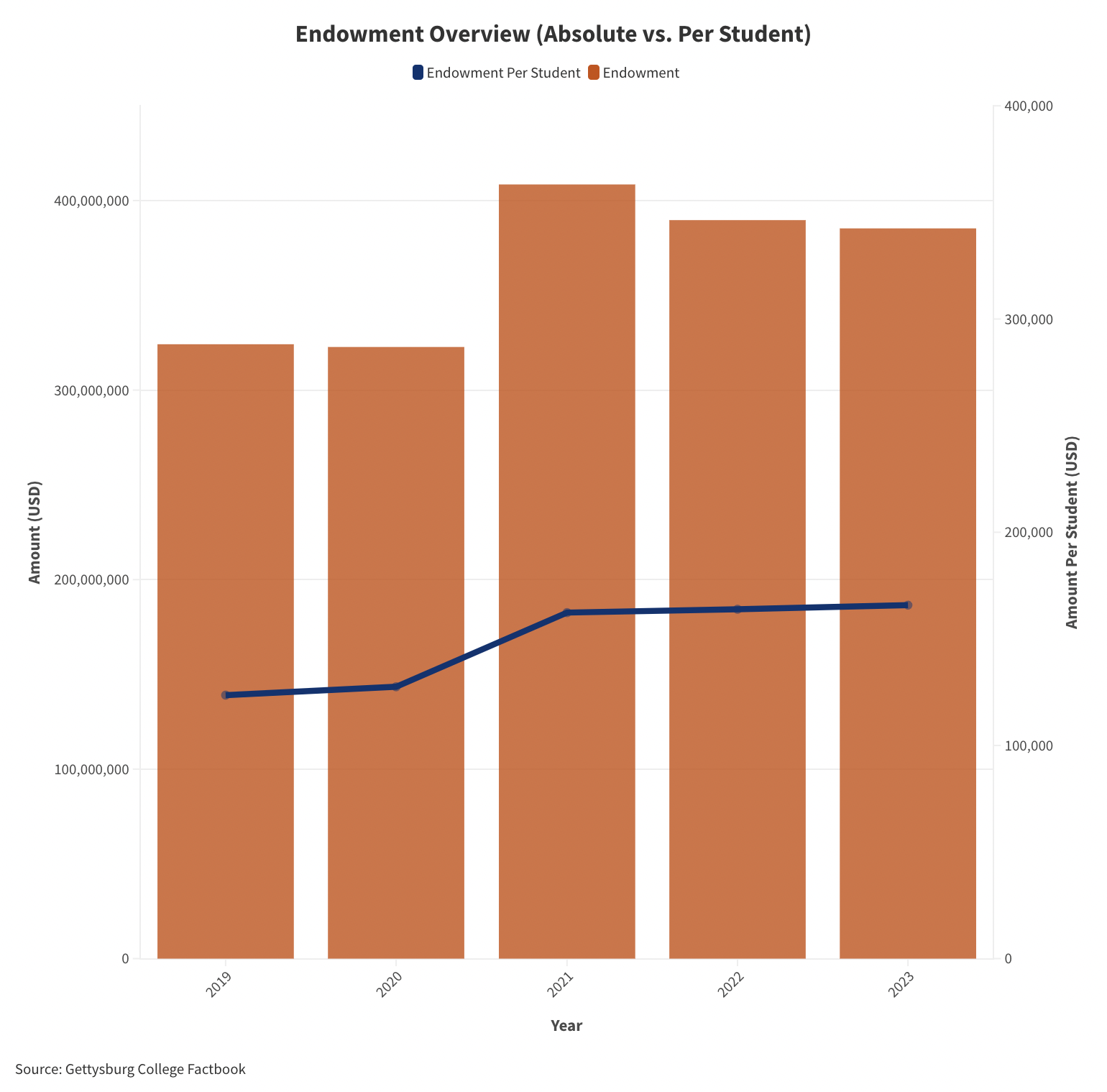

Fact 4: The endowment is decreasing, but the endowment per student is stable.

Visual created by Alfredo Roman Jordan

While I do not work in the Office of Financial Aid, my understanding is that financial aid — the difference between tuition costs and what students pay — is largely funded by the endowment and donor support. The increase in financial aid might explain why our endowment has slightly decreased in recent years, although the College has not been transparent about it (the latest figures are only available by request).

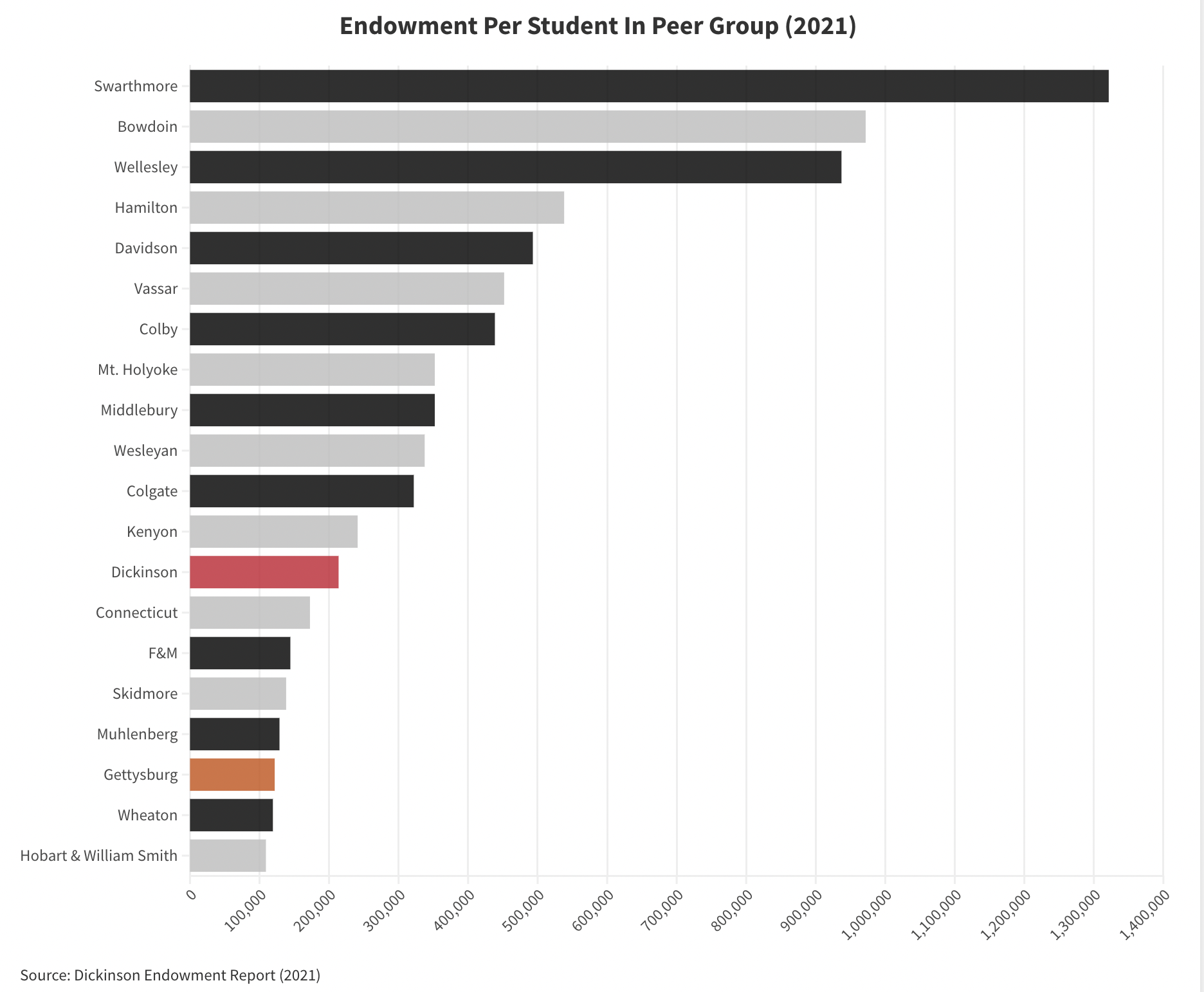

Fact 5: Our endowment per student is already one of the smallest among peer schools.

Visual created by Alfredo Roman Jordan

The biggest concern I have is that if we continue trying to solve our acceptance rate problem by increasing financial aid without addressing underlying cost inefficiencies, we will run into serious trouble. To be clear, I am not saying we should stop giving financial aid, rather, that the current rate at which aid is being distributed is unsustainable. Currently, much of this financial aid comes from our endowment, which is already smaller compared to that of our peer institutions.

In fact, our endowment per student is among the lowest in our peer group, a troubling statistic for long-term financial health. While our enrollment target is around 2,100 students, the only reason we haven’t seen a reduction in endowment per student is because our enrollment has been decreasing, roughly matching our increased aid expenditures. Essentially, the lower enrollment has kept the ratio stable, masking the underlying issue.

However, this stability is fragile. Once enrollment hits a ceiling, which could be as soon as in the next three years, we will not have the declining student numbers to offset our increased spending. Without a plan to cut costs or secure additional sources of income, we risk draining our endowment at a faster pace. If we begin depleting it significantly, the institution will face increasingly limited options to support students and maintain operations at the quality expected of Gettysburg College.

A declining endowment is not just an abstract financial figure, it is the foundation of what allows Gettysburg to support students equitably (through aid), maintain facilities, and invest in research. When an endowment shrinks, it creates a vicious cycle: less funding means fewer resources to invest in students and faculty, which leads to a reduced ability to attract new talent and, ultimately, fewer applications and enrollments. An endowment should not be used to fund daily operations like it is now, it should be used for large projects like quad renovations.

Visual created by Alfredo Roman Jordan

The biggest concern is that the College is caught in a cycle of lowering tuition revenues while also trying to cut spending to balance the books. By offering more aid to attract students, we’re reducing our income per student, which forces us to cut costs further. These cuts affect the quality of education and student experience.

This decline in quality makes Gettysburg less attractive to prospective students, potentially leading to even lower enrollment and less revenue. It’s a slippery slope: each reduction in quality further limits Gettysburg’s ability to compete, pushing us deeper into financial instability. If we don’t find an equilibrium soon, we risk reaching a point where these cuts will no longer be enough to stabilize the college, threatening the long-term future of our institution.

Now, everything but the facts is speculation. But what else is there to do if the College is not transparent about their direction?

November 22, 2024

rather than celebrate the decline in Lutheran students, why not actively seek that market in Pennsylvania and elsewhere? Because you did not market in the South, you lost several potential Lutheran students. The school’s Lutheran profile could be celebrated in these circles without endangering the broader market with some creative and wise niche marketing.